In this article we explain why a competitive advantage no longer exists, and why organizations are not prepared to deal with today’s complexity. Moreover, we will provide guidance to the changes you needed to react adequately to the challenges of today and tomorrow.

What can you expect from this article?

- An in-depth understanding why a sustainable competitive advantage no longer exists.

- An answer to the question why organizations are ill-equiped to deal with this change.

- A solid understanding of the new strategy and organizational structure that is needed.

Competitive Advantage distilled

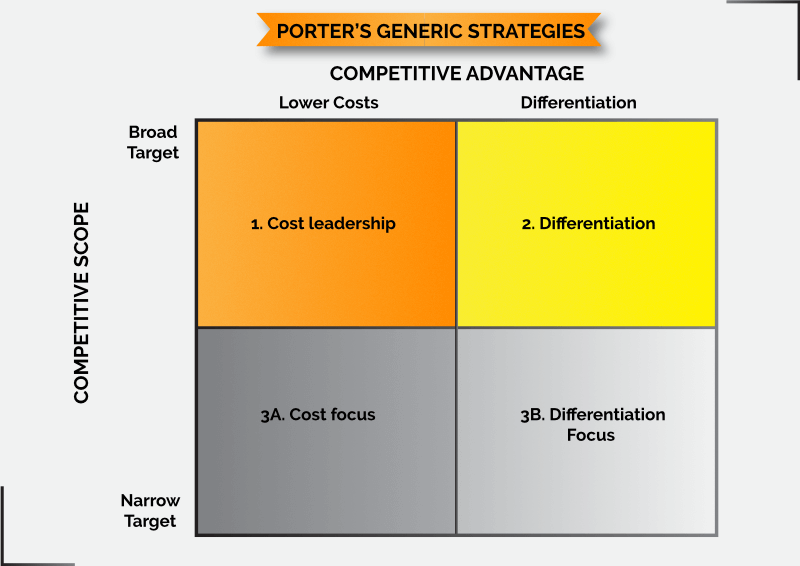

Competitive Advantage is the title of the 1985 book from Michael Porter, undeniably the textbook on this subject. Porter argued that competitive advantage can only be gained in two ways: either your are cheaper than your competitors (cost advantage), or your are perceived differently by your customers in a positive way (differentiation advantage). This leads Porter to define three generic competitive strategies:

The first is Cost Leadership. This strategy is obvious: If a company can produce the same quality of products or services for a lower price, it has a cost advantage over its competitors. The advantage comes from better access to cheap labor f.e.; lower materials costs; economies of scale; or proprietary technology. If a company can produce at lower prices, they can give some of the cost advantage to their customers, increasing their market share.

Differential Strategy means you produce goods or service different from your competitors, and better in the eyes of the customer. The company chooses some characteristic(s) that are valued by customers and pushes itself to excel in those areas. They are rewarded for this with a price premium.

Focus Strategy means the company focuses on a narrow market segment. This could be based on geographic, demographic, or other criteria of segmentation. Once a focus area is chosen, the company must then decide whether to follow a cost leadership or differentiation approach to targeting the market

Michael Porter: Generic Strategies

Porter’s concept is not wrong in itself. The only general criticism I would have is the overly focus on competition. Doing better than your competitors doesn’t necessarily mean doing the best you can. A focus on competitors might cause you to overlook potential threads from those you do not regard as competitors now. This is a common trap, and a more dangerous one in this time of fast change and market disruption. For instance, newspapers looked at other newspapers as their competition for too long. They missed the fact that the new competition came from the internet. Peter Drucker once said: Because the purpose of business is to create a customer, the business enterprise has two–and only two–basic functions: marketing and innovation. We could interpret that as: focus on the customer rather than the competition. I also particularly like his idea of innovation as a basic function. That sounds almost opposite to defending a competitive advantage.

The basis of Porter’s theory is that a company can choose a market now, based on some preferential advantages it has, and maintain those advantages over a long period of time. That requires two things: First, differentiating advantages, whether they are based on cost or differentiation, are substantial enough to beat competition. Second, the market is relatively stable over longer periods to be able to defend the competitive advantages that are gained.

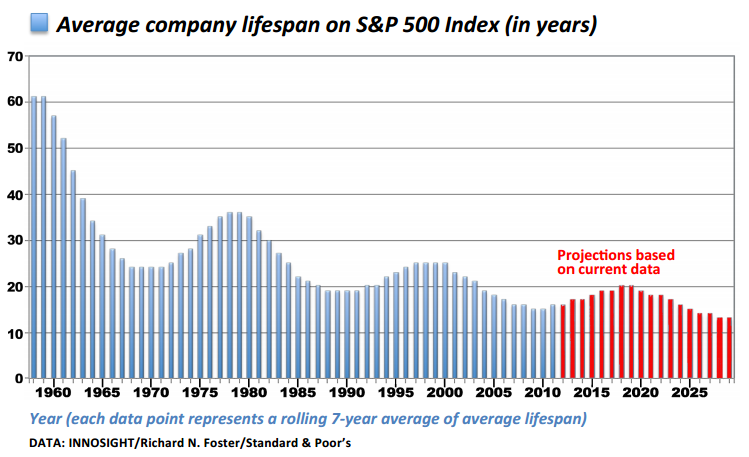

The world is changing

But markets no longer seem stable. Competition seems to come from unexpected places nowadays. Windows of opportunity open and close faster and faster. One indicator for a changing world is the life expectancy of organizations which is declining at an alarming rate. Professor Richard Foster of Yale University led a Innosight study in 20121 that shows that a 61-year tenure for the average firm in the S&P 500 index in 1958 narrowed to 25 years in 1980, to only 18 years now. Even more, at this rate by 2027, over 75% of the S&P 500 will be companies you have never heard of. That is pretty alarming, isn’t it?

Innosight / Richard Foster

We all know the examples of once rock solid names that disappeared or lost most of their relevance. Companies like RIM, the makes of the Blackberry, Nokia, and Kodak. Or Toys ‘R Us which filed for bankruptcy in September 2017. I remember I was really surprised. I guess I just assumed that a company like this could always face any challenge it was presented with over the years, as kids go through tons of toys growing up, right? Apparently it wasn’t. RadioShack was a household name for decades in the US after it filed for bankruptcy for the second time in 2017.

Most companies’ demise can eventually be traced back to a failure to adapt to new circumstances in the market. They held on to their core business model for too long until it was too late to change. They kept on defending their competitive advantage because we design organizations to do so, realizing too late that these advantages no longer existed.

Why a sustainable long-term competitive advantage no longer exists

When I studied Business Administration at the university of Groningen, Porter was one of the great gurus we learned about. His book, Competitive Advantage, creating and sustaining superior performance, was named the ninth most influential management book in the 20th century according to wikipedia2. I still own a copy from that time. So it is fair to say he had a great impact on organizational strategy. It is also fair to say that he was right….at the time. Unfortunately, his notion of sustainable competitive advantage doesn’t hold anymore, at least not to the extent it used to. His research was based on organizations, industries, and market conditions from the fifties to seventies. But a lot has changed in the late 20th and early 21st century.

Digital disruption is the catalyst of many of the changes we see. It made the world smaller but also a lot more complex. It caused disruption of entire industries. It radically lowered barriers of entry for challengers to once established and stable markets.

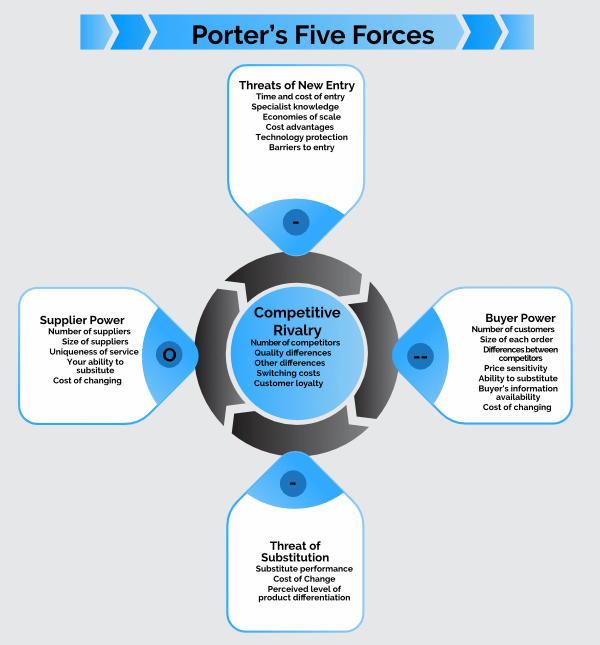

How better to explain why a long term competitive advantage no longer seems to be possible then use one of his own tools. The Five Forces model, originating from the predecessor of Competitive Advantage, his 1980 book called Competitive Strategy, describes five major forces you can use to analyze the competitiveness of a market segment.

Five Forces model, Michael Porter

Threat of new entry

This is perhaps the most important force explaining why a long term competitive advantage no longer exists. The very nature of it means you can successfully defend your competitive position based on some fundamental advantages. But as we will see, the barriers of entry for newcomers have dramatically lowered because of digital disruption. Access to information and knowledge is almost equal for anyone, available at the click of a mouse. Access to talent is no longer geographically bound as people can work anywhere these days. Investment funds, angel investors, accelerator programs, and corporate incubator programs have significantly lowered access to capital to start a business. And at the same time digital disruption has caused the required amount of capital to drop. Launching a product or service, especially online, has never been faster and cheaper. As a result Economies of Scale lost its power to prevent challengers from entering your market. As access to information and knowledge is both easy and cheap, specialist knowledge doesn’t give us an edge either anymore. Technology has become readily available as standardized building blocks which rules out technology protection as a viable option too.

Threat of substitution

The threat of substitutes refers to the likelihood that a customer can substitute your product or service for another or another way to achieve their goals. Switching costs are low these days making it harder to protect your business from substitution. Digital and physical models are mixed creating a new kind of substitute3. Think of Uber that combines the ease of an online ordering process with physical taxis. This hybrid model is another substitution threat to be aware of.

Supplier power

This defines how much power suppliers hold over you, mostly in the form of their ability to increase prices. Digital has disrupted entire supply chains decreasing the power of buyers. In pure digital form the availability of apis and the development of micro services lower barriers for others to start a business and lower the switching costs to another supplier of digital services.

Buyer Power

Buyer power deals with the power that buyers have over you. Are they dedicated to your brand? How easily can they switch? Switching banks is relatively easy these days as is switching energy suppliers and health insurance. So the cost of change is low these days. Overall, this force perhaps has seen the most dramatic change of the five, especially in the B2C market. We have seen a huge move from seller power towards buyer power. What customers want customers get. If it isn’t from you, they will happily take their business elsewhere. Social media and instant and free access to information has increased buying power enormously, it makes the ability to substitute a breeze, as well as competitor comparison.

Competitive Rivalry

Finally Competitive rivalry looks at the number and strength of competitors in an industry. As you can see in the model Competitive rivalry is heavily influenced by the other forces. So it is no surprise that considering all the changes we have seen in the other forces, this force is in flux too. We experience a state of hyper-competition is almost all industries. The speed of change and increased complexity gives birth to new competitors from everywhere. No longer do you solely need to be on the lookout for competition within an industry, nowadays newcomers many times come from outside. Uber wasn’t a taxi company, no more than Airbnb originated from within the hospitality business.

So, the world is changing. The environment organizations operate in is getting more complex and changing fast. Old conditions for a sustainable long-term competitive advantage no longer hold.

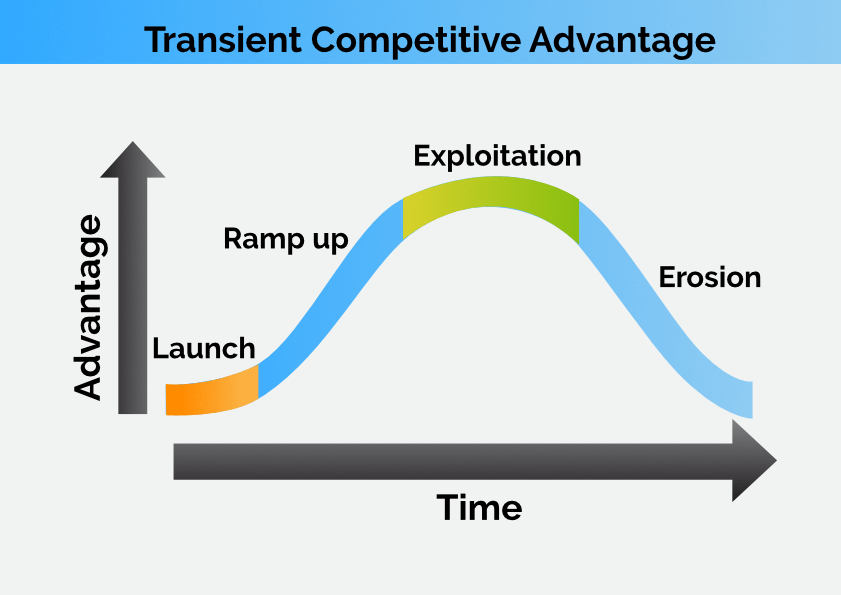

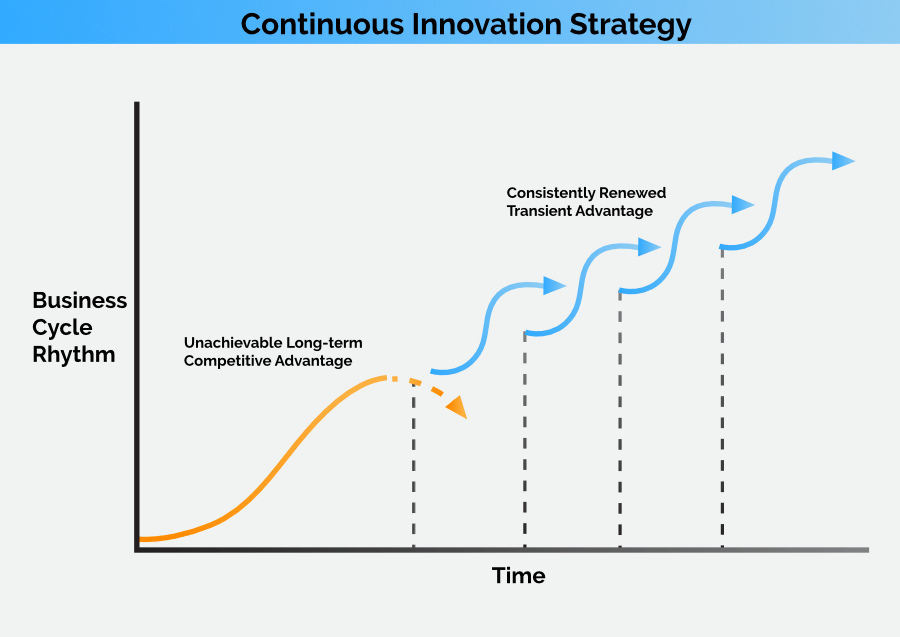

Transient competitive advantage

A new kind of strategy is needed, where sustainable competitive advantage is replaced with, what Rita Gunther McGrath calls, transient competitive advantage4. We should not assume that a competitive advantage can be defended for a long period. Instead, organizations should constantly explore new opportunities and develop new business models. We don’t mean adding a new product or service to the existing portfolio but entirely new business models. The only way to make sure you don’t hold on to an existing business model for too long, is to constantly explore new ones and replacing existing business models with more favorable one’s way before they are at the end of their life-cycle. The idea is to explore many ideas, quickly validate them, carefully nurture a select group of the best business models to maturity, while at the same time pulling out of existing business models in time and free up the resources and people for more favorable ones.

Transient Competitive Advantage

A strategy of Continuous Innovation

Why organizations are ill equipped

The idea of sustainable competitive advantage is well embedded in today’s management thinking, organizational structures, tools and strategy formation. Even if business leaders are realizing that a competitive advantage does no longer hold as long as it used to, the company is still built on that notion and reacts along those lines.

Designed for stability

The required stability for sustaining a competitive advantage and the deeply entrenched beliefs and structures that surround it have created a bias for stability in most organizations. However, as Rita Gunther McGrath puts it: Stability, not change, is the state that is most dangerous in highly dynamic competitive environments.5 To put it the other way around: in order to be competitive in today’s volatile environment, a state of constant change should be the norm. Not stability. Rita Gunther McGrath continues: Think about it: the presumption of stability creates all the wrong reflexes. It allows for inertia and power to build up along the lines of an existing business model. It allows people to fall into routines and habits of mind. It creates the conditions for turf wars and organizational rigidity. It inhibits innovation.

Designed as a closed system

Many organizations still see themselves and their environment as relatively stable and closed systems, thinking they can control the relationships with outside players of the system like customers, and suppliers. But the world got a whole lot more complex. The number of interdependencies between the company and the outside world that influence your company is too large to handle with a linear strategy approach. You cannot predict and plan who your environment influences you. It is no longer a closed system either: you cannot control the environment without thinking it will influence you too, in unexpected ways. That environment got a whole lot bigger as well: local and global politics, climate change, society at large… it is no longer you, your customers, suppliers, shareholders and perhaps the labor unions.

This gives rise to new players that understand the effect of global networks well making them disruptive. Companies like Uber and Airnbnb. They disrupt entire industries because they realize they are not a closed system. The customer is not an outsider that just needs to be influenced and persuaded; the customer is part of the network.

At the same time we see a move from business models based on ownership of products towards access to a network of services. Take the car. Until recently owning a car was holy, business models were all based on ownership of cars. But a car is parked on your driveway for 95% of the time. Uber understands this making them a pioneer in the field of mobility as a service.

Designed for the past

Most organizations are aware of the increased complexity and fast paced change. Yet they still use tools from the past that better fit the relatively stable world of long-term competitive advantage, like SWOT analysis, and conventional competitive and market analysis. This increases the gap between what is needed and what is used. Organizations assume they can predict and control the future based on information from the past. All forecasting and linear strategy techniques are based on this notion. But this does not work well in a complex open system. There are simply too many variables and connection between the variables, to control. Also, cause & effect relationships between the variables are not simply linear.

Instead of controlling the future we need to develop the ability to adapt as the future unfolds. This means we need to continuously explore new opportunities because you simply cannot know in advance which ones will work.

Which changes are necessary?

It is possible to operate successfully in a world of transient competitive advantage versus a sustainable one. But as organizations are designed to defend long-term sustainable competitive advantages, it requires a new organizational design and strategy. This is not an easy feat. But to be honest, isn’t it about time to shed some over one hundred years old organizational and management practices we still use?

Prevent entanglement of old and new business models in budgeting

Organizations and their managers are becoming aware that change and uncertainty will not bypass their organization. However, what is striking is the slow pace at which companies work on new business models as a reaction to these developments. An overwhelming majority of most companies’ resources is still spent on the core business models that are already on decline. Investments in new business models, products, markets, and technologies are still strongly tight to revenues of the current business models, meaning that innovation projects are very vulnerable and are easily downsized or even killed when resources are transferred from innovation projects to core business models under pressure.

As long as budgets are set per department/silo you can bet most money will go to supporting the existing business models because they are making money right now and that is what is being measured by the department’s KPI. There isn’t much motive for managers to invest in the future as long as they are held responsible for the current time. Of course, pressure from shareholders can make this even worse.

It is pertinent to separate budgets of old and new business models. Even better is to make no difference between the two at all and ensure a balanced portfolio of several value propositions at different stages of their life-cycle backup up by a strategy of continuous innovation.

Adopt continuous innovation as a strategy

A crucial step towards surviving in a transient competitive advantage world is to realize that a traditional linear strategy won’t work anymore. Linear strategy means a few people, mostly top management, define the strategy, and the rest of the organization executes it. This assumes you can predict and control the future. You can create a plan, and we only have to execute it. We have seen that this no longer holds in a complex fast changing environment. Therefore, strategy must be defined as it unfolds, which is what we call adaptive strategy. This means we don’t create a strategic plan, we create hypotheses on our market, and our position in it. We then validate the hypotheses using experiments and fast feedback loops. The learnings of these are then fed back into the strategy formation process adapting the hypotheses or creating new ones.

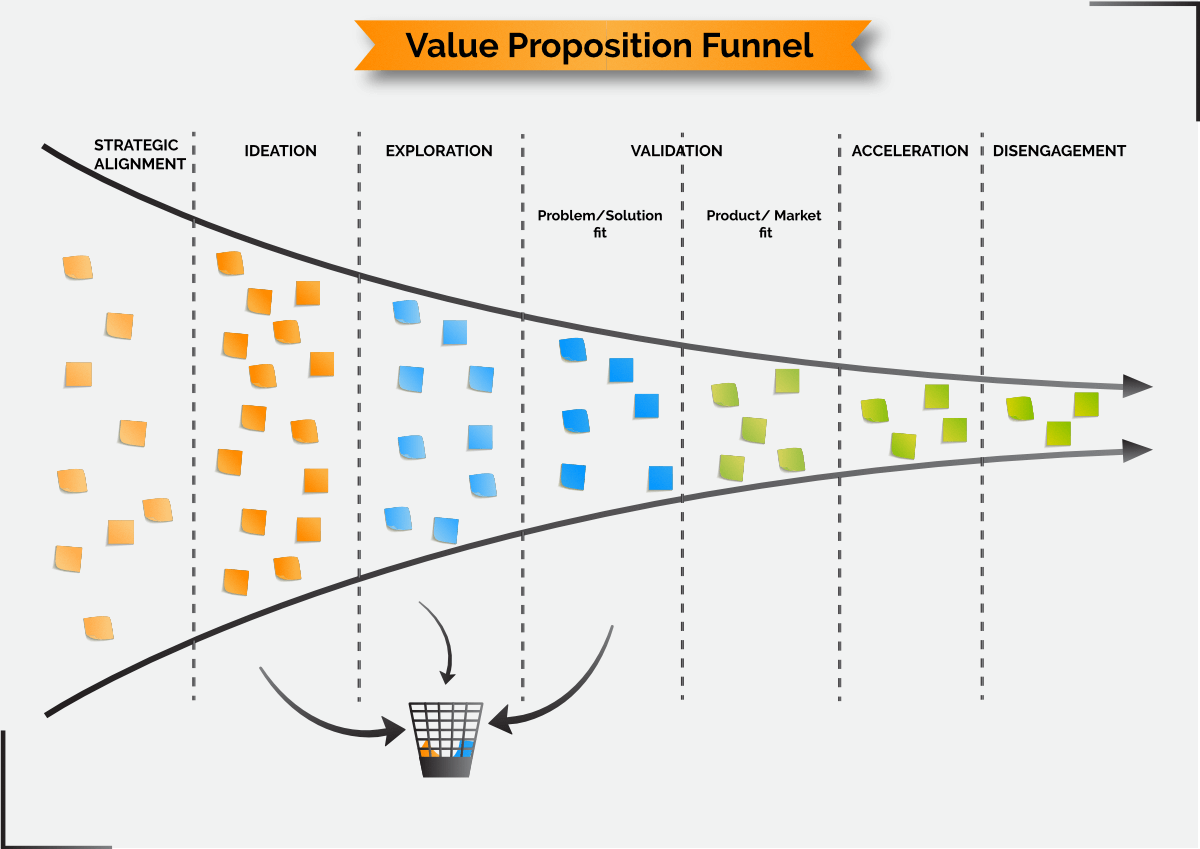

More specifically we adopt a strategy of Continuous Innovation:

We create a continuous flow of new ideas that can originate from any one and anywhere,

define workable falsifiable hypotheses for them,

select the most promising of the ideas after quickly exploring them,

validate the now defined business models both on problem/solution fit, and Product/Market fit,

accelerate growth of the most promising business models,

and disengage in a disciplined way from older business models in favor of more favorable ones.

All in continuous mode.

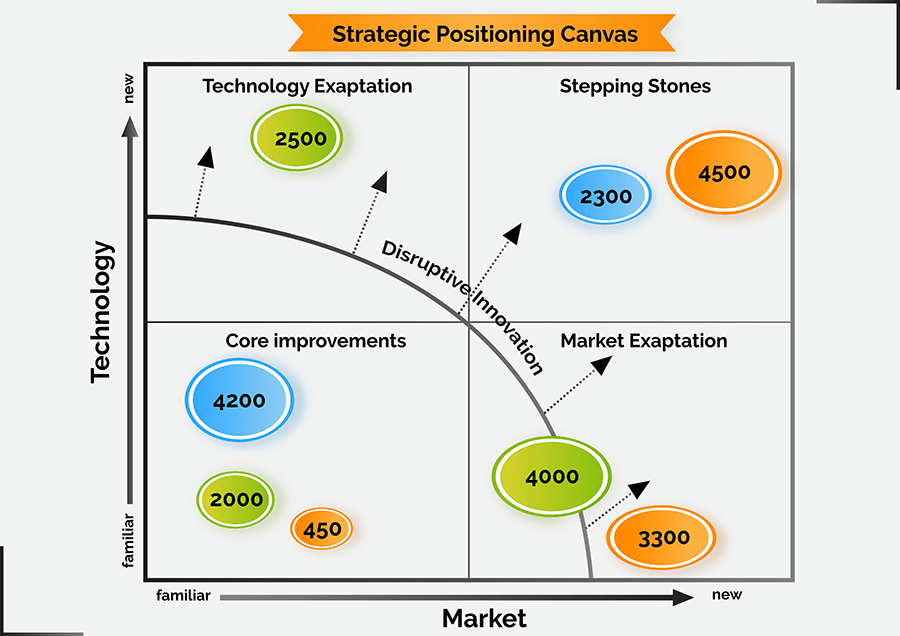

Note that after a while there is no distinction anymore between the ‘old’ business model and models coming out of innovation. There is just a portfolio of different business models, or value propositions, in different stages of their life-cycle. To ensure a balanced portfolio, we have several strategic alignment tools like Purpose & Values, and a Strategic Positioning Canvas. Purpose act as a north star, it ensures new ideas fit within the fundamental raison d’être of the organization. The Strategic Positioning Canvas aids in balancing the portfolio in risk vs degree of disruption. It ensures our portfolio is ambitious enough while not overly risky.

Incorporate innovation into the core organization

A phenomenon we often see is companies creating special structures for disruptive innovation outside of the regular organization, like innovation labs, or internal accelerator programs. When asked why the usual response is that is hard or too slow to innovate within the regular organizational structure. I cannot think of better proof that these organizations are not ready to adapt, or to survive in the long term. Organizing disruptive innovation in separate external organizational units is just an excuse not to fundamentally change the organization itself.

Continuous innovation needs to be a core capability of the entire organization. If not, what happens when the new product or service becomes successful and more mature? Do we move it back into the parent company where nothing has changed? That would mean management believes you only need to organize innovation itself differently but running the business can be done the way we are used to. It would mean that the competitive advantage of the once innovative product is now being fiercely defended again, where the organization actually should be on the lookout for new opportunities already.

Innovation labs, accelerator programs, they can all help to get innovation going, But what is vital is the acceptance that it is a temporary solution to kick-start innovation. In parallel the company must develop continuous innovation as a core capability of the organization. .

organize around opportunities

A strategy of continuous innovation is an important first step. This will also ensure that entanglement of budgets of new and old business models is prevented. But is doesn’t change the organizational structure yet. We still need a structure that better fits the starting, scaling, and stopping of new business models. One that also incorporates innovation into the core organization rather then externalizing it.

One such structure is a fluid organization around the value propositions in the portfolio. The organization is divided into small highly autonomies mini companies that have all the knowledge, expertize, and resources to optimally grow their adopted value proposition. Such units are fluidly formed when new ideas make into value propositions. But they are just as naturally disbanded when a unit’s value proposition is disengaged.

Conclusion

The concept of sustainable competitive advantage still dominates today’s strategy formation. Moreover, the entire structure of the organization and the tools used are meant to defend a long term competitive advantage. But the world has changed. Increasing complexity and fast-paced change, largely caused by digital disruption, has all but ended the notion of a sustainable competitive advantage. Using Porter’s own Five Forces model it becomes clear barriers of entry have dramatically been lowered making it easier than ever before for newcomers to enter the market. Substitution of your products and services is easy because of low switching costs. Buyer power is high because of low switching costs, easy competitor comparison, and a high ability to substitute your products. A new strategy is needed, based on the notion on transient competitive advantage which is based on the constant exploring, validating, scaling, and disengaging of new opportunities.

But organizations are ill equipped to deal with this change. They are designed for stability which is exactly the opposite of what is needed in a transient market. They are designed as closed systems that assume they can predict and control their environment. The truth is that today’s business environment is tremendously complex which means the sheer number of variables and connection between variables is simply too large to predict and control. They are also designed for the past using traditional forecasting tools in an unpredictable world.

To cope with the demise of the sustainable competitive advantage we propose four fundamental changes: The first is to make sure that budget of innovation cannot be influenced by the current business models. Secondly, the company needs to adopt an adaptive strategy of continuous innovation where new ideas can come from anywhere and any one. New ideas are modeled in an exploration phase where after the most promising ones are validated in validation phases. The surviving value propositions become part of the official portfolio and are scaled up until the point that disengagement in favor of other more promising propositions is wise. The third change deals with the location of innovation: do we externalize it, or make it an integral part of the core organization? This question is clearly answered in the fourth proposed change of a new fluid organizational structure where highly autonomous units are dynamically formed around maturing value propositions.

It is possible to survive the end of sustainable competitive advantage and thrive in a world on transient competitive advantage. But there are not shortcuts and organizations need to be willing to abandon some of their beloved structures and tools that have been in use for over one hundred years.

Follow this article

You can choose to follow this article in which case you will be notified when there there are updates of the article. You can also choose to follow all articles of this category. You will then be notified if a new article is added in this category.

Bibliography

List of notes and sources we reference from.

Notes

- https://www.innosight.com/insight/creative-destruction-whips-through-corporate-america-an-innosight-executive-briefing-on-corporate-strategy/

- https://en.wikipedia.org/wiki/Competitive_advantage

- Nicholas D. Evans. How digital business disrupts the five forces of industry competition. https://www.cio.com/article/2976572/emerging-technology/digital-disruption-from-the-perspective-of-porters-five-forces-framework.html

- McGrath, Rita Gunther. (2013). The end of competitive advantage. Harvard Business Review Press.

- McGrath, Rita Gunther. (2013). The end of competitive advantage. Harvard Business Review Press. P. 7.